Canary in the Coal Mine? Foreclosures in the news

While Chicago is not suffering the mortgage crisis as painfully as residents of the Coasts, Florida and Las Vegas, more and more foreclosure news has been creeping into the news lately.

A roundup of foreclosures in the news in the last month:

March 3 Crain's Chicago Business

Foreclosure flu spreads: 14,250 foreclosures in 2007, a 46% increase over 2006.

Northwest Side neighborhoods like Albany Park, Logan Square and Portage park saw their numbers more than double, according to a new report provided to Crain's ahead of it's scheduled release.

Those areas drew newcomers in large numbers in recent years as first-time buyers sought affordable alternatives to pricier city neighborhoods like Lincoln Park, Lincoln Square and Lakeview.

Tower builder tie-up: Related Companies and Magellan discuss a combo as two major projects falter.

Talks to combine two of the Chicago area's largest developers come at a critical time for Related Midwest LLC. The luxury condominium developer is struggling with a slow sales start at its two newest projects and has been without a president.

Related Midwest LLC developments include:

- 340 on the Park - already completed

- Canyon Ranch Living - planning

- Pestigo - Planning

- Roosevelt Square - Under construction

Magellan Development is currently building several high rises at Lakeshore East on the New East Side.

Decline seen in apartment sales

Sales of Chicago-area apartment buildings could drop 30% this year, to $1.08 billion, from a record breaking 2007, according to a report from CB Richard Ellis, Inc.

Signs of the slowdown were evident late last year, a time when sales activity typically spikes as investors hurry to complete deals before yearend. But only 42% of the Chicago deals close din the second half of last year, as opposed to 69% in the last 6 months of 2005, the previous record year when sales totaled $1.89-billion.

March 10 Crain's Chicago Business

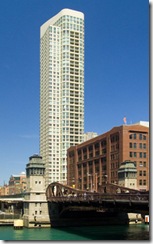

A Sterling example of condo Bust: Foreclosures, falling prices: a bad omen?

A Sterling example of condo Bust: Foreclosures, falling prices: a bad omen?

Over the past three years, lenders have filed 95 foreclosure suits, accounting for about $40-million in loans, on condominiums in the 389-unit high-rise, fueling a big drop in condo values throughout the building.

The tower represents a worst-case scenario in a downtown condo market that is weak but so far hasn't seen the falling prices and rising foreclosures that have afflicted once-hot markets like South Florida. The real test for condo owners will come over the next two years, when downtown developers are expected to complete more than 10,000 condo's, an unprecedented jump in supply.

A nice building in a superior location seems an unlikely victim of rampant foreclosures, but artificially propped up prices along with developer incentives may have played a part in its unfortunate predicament.

American Invsco Corp attracted a lot of investors with incentives such as two years of free taxes, two years of free assessments, and artificially propped up cash flow. One incentive offered to make up the difference between the rent and the mortgage + tax + assessment payments for a two year period.

It was too good to be true for some buyers. As the incentives wore off, many buyers saw their monthly payments soar to unsustainable levels.

A trickle of foreclosures in 2004 grew to a flood in the next three years. Nearly 1/3 of foreclosures involve owners with multiple units in the building.

An American Invsco spokesman blames the Sterling's troubles on the depressed market: "It has nothing to do with our program."

In more stable neighborhoods where the inventory supply is more limited and there is not as much speculation, the number of foreclosure epidemic seems quite limited. In the Lakeview neighborhood, for example, only had 126 foreclosures, but this represented a 94% increase from 2006.

It's interesting to watch the tale of two cities developing right inside the borders of Chicago.

0 comments:

Post a Comment