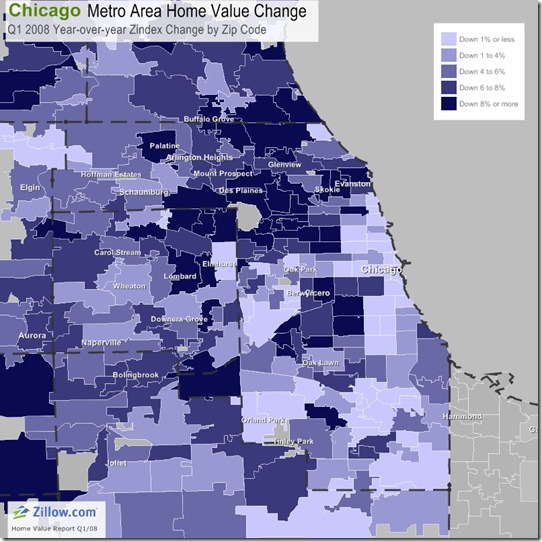

So you've finally saved up your down payment for your new home. Heck, you even realize that now might be a good time to buy if you have predicted that we've hit bottom and prices are as low as they're going to go.

But do you know all the costs involved in buying a new home in Chicago? Let's dive in.

First, you'll pay your lender an application fee. They generally run $250 to $500. You will pay this up front at the time of your loan application. This fee covers your credit check (around $50 worth) and the appraisal on your property. Some lenders will credit this back to you at closing.

Most people want a home inspection. You'll pay your inspector anywhere between $250 for a simple condo to $800 for a 4-flat building. You'll pay your inspector up front.

Points: Points are pre-paid interest to reduce the interest rate on your loan over the long run. I haven't had anyone pay points in the last 10 years, so let's not worry about them.

The City of Chicago will charge you $7.50 per $1,000 of your purchase price. Or $750 per $100,000. On a typical $300,000 condo, this works out to $2,250 in transfer taxes. This is the big one ~ so be aware. (There are taxes levied on the seller as well, but let's save those for another post.)

If you put less than 20% down on your new place, you'll probably pay PMI (Private Mortgage Insurance.) This will typically cost 0.5% to 1% of your loan at closing. (And more over the life of the loan.)

Here in Illinois, Lawyers run the closing. Most attorneys charge a flat fee to look over your contract, and then babysit your contract to closing, as well as babysit you at the closing table. You'll pay $450 to $800 for the privilege.

Title Insurance: the seller will buy you insurance - so you think you're covered, right? But you have to buy it for your Lender/Bank/Mortgage company. This will run about $400 additional.

Other fees will add up to around another $400 to $800. These B.S. fees include things like:

- $35 for a flood certificate. This irks me to no end, because the entire City of Chicago is NOT in a flood plain, but buyers are required to purchase a certificate that SAYS the same thing from the U.S. Government.

- Escrow charges. These are fees that the Title Company charges to mind the incoming and outflowing money. It's usually a requirement of your lender ~ and therefore, you're stuck paying a fee to rent the conference room at the title company. Otherwise you could close in your living room.

- Wire fees. Of course, you borrowed the money, but your lender charges YOU $50 to send the money to the Title Company.

- Overnight fees. You just signed your big fat loan package. The Title Company charges you $50 to FedEx it back to the lender.

- Recording fees. These are worth it. A representative from the Title Company goes down to the Recorder's Office and stands in line; pays your recording fees, and records all your documents into the public record. And they charge you a premium to do so.

Other little surprise items:

- Did you buy in a new condominium? Then you'll pay up 2 or 3 months of assessments to get the reserve fund started. Bye Bye $300.

- Ditto? Then you'll pay the developer back for the building insurance policy that he pre-paid for, but you get the benefit of after you own your new condo. Another $200.

On the same $300,000 condominium from our example above, it would be wise to budget an extra 2% - $6,000 - in closing costs on top of your down payment for the property.

Now, let's see if the math holds up.

- $450 Loan app.

- $300 Inspection.

- $2,250 Chicago Transfer Tax.

- $500 Attorney fee.

- $1,450 PMI

- $400 Lenders policy

- $35 Flood

- $200 Escrow charges

- $50 Wire

- $50 Overnight

- $100 Recording

- Grand Total: $5,785 (Not Bad!)

All of these charges are added up on your "Settlement Statement" which also goes by the name "HUD1" or "RESPA." It's a standardized spreadsheet or balance sheet that is prepared for every closing.

Ask your lawyer to send you a copy of your statement a day or 2 in advance - maybe he'll have all the figures. But it's also likely he won't, and you won't see your settlement statement until closing. On the other hand, you should be given the "Final Figure" which is the size of the check you should bring to closing - and it contains all the numbers on the "RESPA" but not all typed up and formal. You should find out your "Final Figure" a day before closing so you have time to go to the bank.

The final piece of advice - you will need to bring a cashier's check to the closing. No personal checks. And remember to bring your Drivers' License. You need proof of identity to close.

942 North Fairfield - the Fairfield Greystone

942 North Fairfield - the Fairfield Greystone 2946 North Wood, Unit D - Wellington Park Townhome

2946 North Wood, Unit D - Wellington Park Townhome 1800 West Erie, #14 - West Town Penthouse

1800 West Erie, #14 - West Town Penthouse